This year’s tax season opens on July 7 and the South African Revenue Service (SARS) says it is making it simple for taxpayers to meet their legal obligations.

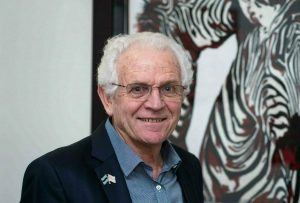

“The timely submission of accurate personal income tax returns is important for a seamless tax season. This year, taxpayers must take control of their own tax affairs, by ensuring they know what their obligations are and comply with them,” says Edward Kieswetter, commissioner of the SARS.

“SARS continues to use technology, the extensive use of data enhanced by machine learning, algorithms and artificial intelligence to make this possible. We also continue to make progress in various aspects of online and direct walk-in tax services through an investment in our people.”

Kieswetter says the improvement in service delivery must ensure that there is actually no need for walk-in consultations and long queues at branch offices.

Auto-Assessment

From Friday 30 June, SARS will communicate directly with selected taxpayers via SMS and inform them of their automatic assessment. Taxpayers access this auto-assessment through any of SARS’ platforms (such as the mobile app or eFiling platform) to review the completeness and accuracy of the auto-assessment.

Taxpayers who have been selected for auto-assessment can accept it without any amendments or, if there is a valid reason, amend and resubmit together with the necessary supporting documents.

Those who accept the auto-assessment without modification and qualify for a refund will receive it in their bank account within 72 hours after a notification about it has been sent out.

If the return is amended, it is considered again. A revised assessment can then be issued. If money is owed to SARS, it can be paid through the various platforms.

The revenue service has asked people selected for auto-assessment to use patience and not visit a branch or call the progress helpline.

“SARS will proactively and continuously communicate with such taxpayers.”

If a taxpayer is still haunted by a return, an appointment can be made at one of Jan Tax’s branches.

Taxpayers who do not receive an auto-assessment and must submit a return can do so from 7 July to 23 October.

If all information on the return for the current year is accurate, the transaction will not take more than ten seconds, says SARS.

Provisional taxpayers and trusts can file returns between 7 July and 23 January.

Don’t take chances

SARS says its use of technology and data strengthens its ability to sniff out incidents of non-compliance. “Taxpayers should not inflate their expenses and under-declare their income to get impermissible refunds. This could potentially make a taxpayer guilty of fraud,” warns the revenue service.

SARS also warns that it will make it “difficult and expensive” with stiff fines for taxpayers who submit dishonest returns.