Most South Africans who rent homes do so for financial reasons – with almost half of people admitting they simply cannot afford to buy a property.

The credit bureau TPN says in its latest report on trends in the rental market that the high interest rate, inflation and limited job opportunities have a significant effect on the ability of many people to own their own homes. Almost 10% of respondents are prevented from owning their own home due to a poor credit record.

TPN conducted the survey among more than 170,000 tenants, with 19,000 complete response sets ultimately received. The company says this makes the survey the largest holistic tenant survey in South Africa.

According to the report, people don’t just rent because it’s all they can afford. More than 17% of respondents rent a house – rather than buy one – because they prefer its flexibility. A total of 11.4% believe it is cheaper to rent a property than to buy, 2.2% simply do not want to incur the debt and 1.8%’s decision is driven by political uncertainty.

Another 0.8% of people indicated that they are going to emigrate, or intend to leave the country, and therefore prefer to rent a house.

More women than men hire

According to the survey, women usually rent cheaper accommodation compared to men. A total of 10.4% of female tenants pay R3 000 or less per month in rent and only 0.4% pay R25 000 or more per month for a rental house.

Most women who rent houses spend on average between R4 500 and R7 000 per month on rent.

Men tend towards the higher rental segment, with 7.2% spending R3 000 or less per month on it.

Most men pay between R4 500 and R7 000 per month, with a third paying between R7 000 and R12 000 per month in rent.

Only 0.8% of men pay R25 000 per month or more for a rental property.

More than half of female respondents rent a house because they cannot afford their own property. This is 10.2% more than men who have other reasons for this.

According to the survey, men are more likely to be concerned about political uncertainty in South Africa, they are emigrating or struggling with poor credit records – especially those between 40 and 49 years old.

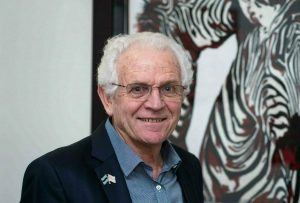

Waldo Marcus, operating principal at TPN, says men are also more inclined to believe it is cheaper to rent than to buy a property.

“Older respondents are more focused on avoiding debt and are more concerned about political stability. Younger respondents, on the other hand, are more concerned about political and financial risk,” says Marcus.

Lower rent escalation, no deposit

Regarding the ideal rental agreement, many respondents (37.8%) prefer terms that include lower rental escalation and no requirement for a deposit. They are willing to enter into a rental agreement for a longer period.

This type of agreement benefits landlords, says Marcus; it offers more security, fewer empty properties and a steady income stream.

Deposits do give landlords some security, but they can also be a barrier for prospective tenants. Alternative solutions, such as deposit insurance, are a new trend that benefits tenants and owners.

Tenants are also more concerned about the flexibility of a contract, rather than about shared spaces such as communal gardens or other facilities.

Most respondents (20.2%) prefer detached houses. This is followed by sectional title apartments and townhouses (both 19%), with cluster housing in complexes the last option.

Men are also more likely to prefer detached rental homes.

Poor maintenance

In a surprising twist, paying rent is not the biggest challenge for tenants – it is landlords who fail to carry out repairs and renovations to the property.

Paying the monthly rent is the second biggest challenge and is followed by access to proper parking and a lack of control over the cost of utilities.

“The ability to manage the cost of utilities more independently will not only help investors and management to make their asset more attractive to prospective tenants, but will also counter one of the rental market’s biggest challenges,” says Marcus.

“Understanding tenants’ preferences is about more than knowing what they want; the knowledge must be used to guide plans for new developments, investment strategies, marketing and resource allocation.

“This understanding is again converted into a lower vacancy rate, improved rental growth and balanced future supply and demand and makes it a practical and valuable tool for any property portfolio.”